Finance / Zimbabwe

Liquidity crunch tightens as markets look East for cash injection

While the country takes actions to fight inflation and strengthen its banks, chinese loans plug the shortage of cash

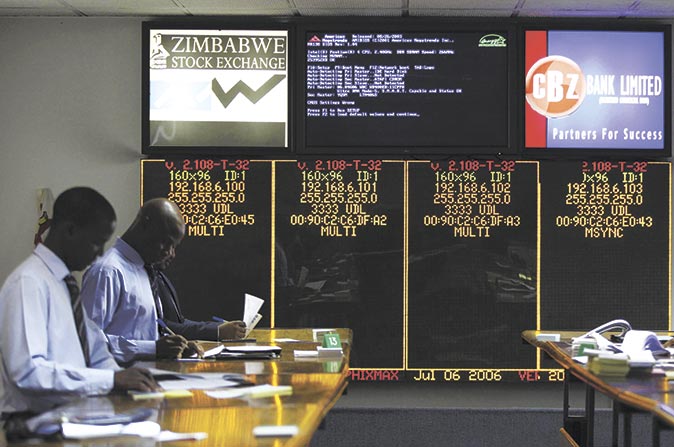

Stockbrokers work on the floor of the Zimbabwe Stock Exchange in Harare.

Five years after the adoption of the multi-currency regime put an end to hyperinflation, Zimbabwe’s financial sector is facing an acute shortage of cash. With sanctions and high levels of debt restricting Zimbabwe’s access to cheap loans from international financial institutions, the supply of money is low.

This shortage of cash has restricted small and medium-sized enterprises’ ability to borrow, constraining output and demand. The few lines of credit that have trickled in have come at high rates of interest. Fears for banks were raised when 18 percent of loans were recorded as Non-Performing Loans (NPLs).

Since the crunch, the Reserve Bank of Zimbabwe (RBZ) resumed hosting the government exchequer account after a $100 million recapitalization. The bank set up the Zimbabwe Asset Management Company to absorb $300 million of these NPLs. To fight inflation, it introduced bond coins valued at $50 million to allow for more efficient pricing and to help restart interbank lending, it also received a $120 million facility from six local banks.

The Zimbabwe Revenue Authority is relaxing the process by which citizens become a bank’s customer, as there is an estimated $7.5 billion circulating outside the sector. CBZ’s CEO Never Nyemudzo said, “Our approach is to get those unbanked into the banking sector. They get registered and pay their taxes.”

Chinese financing has helped plug the shortage. Over $1 billion in concessionary and preferential loans have eased the lack of cash, as have high levels of foreign direct investment (FDI). Between 2005 and 2013, 82 percent of all FDI into Zimbabwe came from a Chinese source, an amount totaling $1.2 billion. Indeed, as of last year, Chinese financing in Africa increased to $30 billion. As the financial sector continues to stabilize, Chinese investments and loans are helping provide urgently needed cash to secure its long-term future.